Where people come first and mortgages come naturally.

Clear, honest mortgage guidance for Minnesota families & homeowners.

More than just a transaction.

Guidance.

Clarity.

Trusted. Professional.

Minnesota Mortgage Experts You Can Trust

Buying a home should feel exciting, not overwhelming. At Equity Source Mortgage (NMLS #295556), we make the mortgage process clear and stress-free, giving you the confidence to find the right loan and the right home.

First-Time Homebuyers

Guidance and programs designed to make your first purchase possible.

Special Programs

FHA, VA, USDA, and renovation loans tailored to your needs.

Refinance Expertise

Proudly serving Minnesota families with personalized mortgage solutions.

Home Loans in Minnesota Tailored to You

First-Time Homebuyers

Navigate the mortgage process with step-by-step guidance.

Move-Up Buyers

Upgrade to your dream home without the stress of managing two mortgages.

Veterans & Rural Buyers

VA and USDA loans designed for your unique needs.

Real Estate Investors

Financing strategies that support long-term wealth growth.

Refinance Your Mortgage

Take advantage of lower rates, shorten your term, or tap into equity for renovations, debt consolidation, or major purchases.

Our Minnesota Mortgage Process

Getting a mortgage in Minnesota doesn’t have to be stressful. At Equity Source Mortgage, we’ve simplified the process into four clear steps, so you always know what’s next. From your first consultation to closing day, our team walks with you, making sure every detail is handled and every question is answered.

Connect

Schedule a free consultation with a Minnesota mortgage expert.

Plan

We’ll match you with the right loan, whether you're buying or refinancing.

Close

Our team handles the details, keeping the process smooth and stress-free.

Celebrate

Enjoy the moment you’ve been waiting for and the future you’ve worked for.

Your Homebuying Concierge

Why juggle multiple searches and strangers when you can be introduced to a trusted professional?

As part of your journey with Equity Source Mortgage, we’ll personally connect you with one of our preferred real estate partners, agents who know the Minnesota market and put families first.

Testimonials

Happy Minnesota Families Who Refinanced & Bought with ESM

Shawn could not have made the process of getting our first home any easier. He is very patient and will answer any and every question you have. He is also ready to take the lead and let you know what is needed from you and when if you prefer to trust him with the details. Due to Shawn’s hard work our loan was ready to close multiple weeks before closing. We highly recommend Shawn and have even referred him to our own family.

Working with Equity Source Mortgage is a wonderful experience. They walked through the whole process, answered MANY questions and went above and beyond.

Recently had occasion to refinance my mortgage. The folks at Equity Source found a lender with a better rate and saved me $200 / month. I was very pleased with the speed to lock in the best rate, the ease of signing initial paperwork via the electronic signature , and the Tltle Company Equity Source chose for the final closing. I worked with Jason Walters at Equity Source. He was Very easy to work with , and very knowledgeable .

First off, the fact that Shawn stuck with me for the last 2 years while I worked on the financing side of things was awesome. I doubt many would do that. Second, Shawn was very accessible and I think that gave me piece of mind that if there would've been any problems they would've been fixed immediately. The write-ups Shawn did to show cost break down of the houses I was interested in helped a lot as well. Shawn definitely knows his stuff!

You rock, Mister (Shawn)! I so appreciate all the 'butt' you have kicked--including your own to make this happen! You've got an awesome mix of professionality & relatability, including humor--which definitely makes this process more enjoyable. After this, I'll be giving you the next couple years off!! Take care!

I was referred to Shawn Hunter when I was preparing to purchase my first home. As we all know buying your first home is beyond stressful. Shawn took the time to ensure that I understood the entire process, and that I was comfortable every step of the way. He was thoughtful, patient and exceptionally attentive. Going into purchasing my second home I knew he would be the first person I would call upon to assist me through this process. He once again ensured I go the best rate possible, answer my million random questions without hesitation and has been the greatest asset. He will forever by my Mortgage Broker of choice.

Beyond the Mortgage: Helping You Find Your Home

Securing the right loan is just the beginning. Through our Homebuyer Concierge Service, we’ll personally connect you with recommended Minnesota realtors who know the market inside and out. It’s our way of making sure you have the right team beside you, from pre-approval to closing day.

MEET Equity Source Mortgage

people first, mortgages naturally

At Equity Source Mortgage, we sit on your side of the table. Buying a home, or refinancing one, shouldn’t feel overwhelming. That’s why since 2000, we’ve built a solid reputation on honesty and transparency by putting our clients' needs first.

Led by Owner & President Shawn Hunter (NMLS #348864) with Founder & Vice President Roy Sperr (NMLS #202418) and Mortgage Loan Officer Jason Walters (NMLS #2097709), our team pairs straight talk with speedy pre-approvals and trusted local partners.

If you want a mortgage experience that feels personal, professional, and hassle-free, we’d love to help.

How Much Home Can You Afford in 2025? A Simple Guide for Minnesota Buyers

Buying a home is exciting. It’s also a big step. One of the first questions people ask is: “How much home can I afford?” The answer depends on your income, your assets and your debts, and the type of ... ...more

Mortgage

October 03, 2025•3 min read

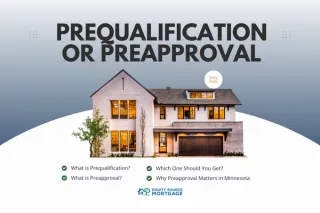

Prequalification or Preapproval: What Minnesota Homebuyers Need to Know for Minnesota Buyers

When you start thinking about buying a home, you’ll hear two words a lot: prequalification and preapproval. They sound alike but they are very different. Understanding the difference will help you ge... ...more

Mortgage

October 02, 2025•2 min read

How Much Down Payment Do You Need to Buy a Home in Minnesota?

One of the biggest questions buyers ask is: “How much money do I need for a down payment?” ...more

Mortgage

October 01, 2025•1 min read

At Equity Source Mortgage, we’re more than loan officers, we’re your lifelong partners in homeownership.

Whether it’s your first home, your next home, or simply making your current one the right fit through refinancing, we’re here to guide you with clarity, care, and confidence.

NMLS #295556

Quick links

Loan Options

© Equity Source Mortgage. 2026. All Rights Reserved.